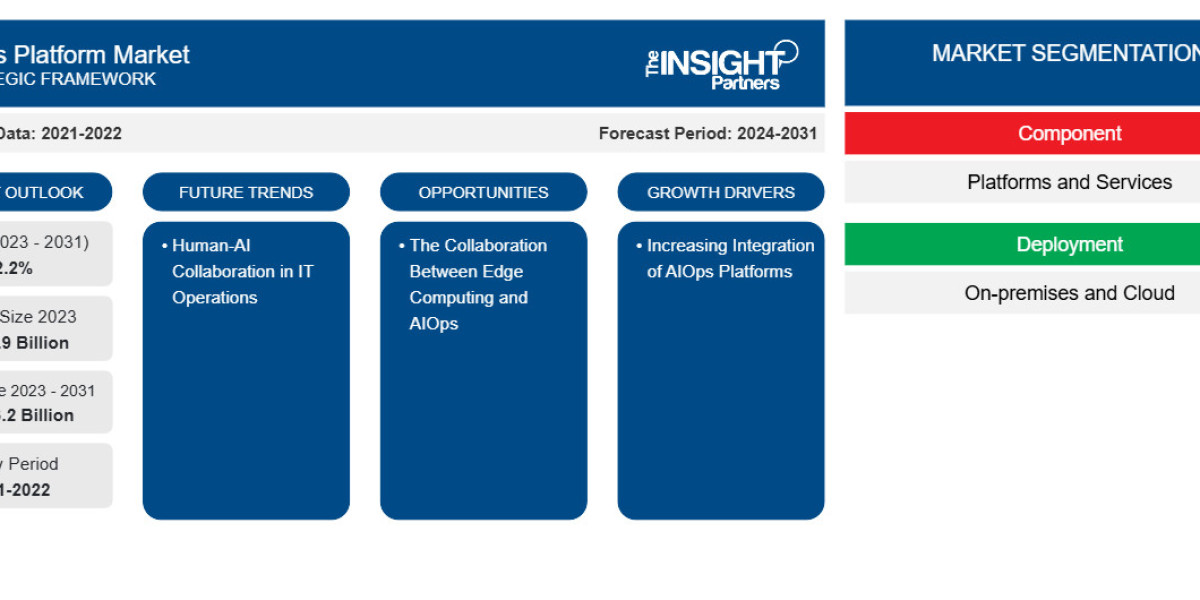

AIOps Platform Market Size and Growth Outlook (2021–2031)

Between 2021 and 2031, organization size–based adoption is expected to significantly shape the AIOps platform market. Large enterprises have historically dominated market revenue due to higher IT budgets and complex operational needs. However, SMEs are emerging as a high-growth segment, driven by affordable cloud-based AIOps offerings and the increasing availability of managed services.

As enterprises across sizes face growing IT operational challenges, AIOps adoption is transitioning from a “large enterprise-only” solution to a mainstream IT operations tool.

Large Enterprises: Market Dominance and Mature Adoption

Large enterprises account for the largest share of AIOps platform revenue. These organizations operate highly distributed IT environments that include data centers, cloud platforms, edge devices, and thousands of applications. Managing such complexity without intelligent automation is no longer viable.

Large organizations deploy AIOps platforms to:

Correlate millions of IT events in real time

Reduce alert fatigue across operations teams

Enable predictive maintenance and capacity planning

Improve service-level agreement (SLA) compliance

Leading vendors such as IBM, Broadcom Inc., Splunk Inc., and Dynatrace LLC provide enterprise-grade AIOps platforms tailored for large-scale operations. These solutions often integrate with IT service management, network monitoring, and security tools to provide a unified operational view.

Due to regulatory and compliance requirements, large enterprises frequently adopt hybrid or on-premises AIOps deployments, supported by extensive professional services.

SMEs: Fastest-Growing Adoption Segment

While SMEs contribute a smaller share of total revenue today, they represent one of the fastest-growing segments in the AIOps platform market. SMEs face increasing IT complexity due to cloud adoption, remote work, and digital customer engagement — yet often lack large IT teams.

Cloud-based AIOps platforms offer SMEs:

Subscription-based pricing

Rapid deployment with minimal infrastructure

Automated incident detection and resolution

Reduced dependency on manual monitoring

Vendors such as Moogsoft, Resolve Systems, LLC, and AppDynamics have introduced simplified and scalable AIOps solutions specifically designed for smaller organizations. Managed AIOps services further lower adoption barriers by providing expert support without requiring in-house AI expertise.

Adoption Challenges by Organization Size

Despite growing interest, adoption challenges persist:

Large enterprises face integration complexity and long deployment cycles

SMEs may struggle with data quality and AI skill gaps

However, ongoing advancements in platform usability and service delivery models are steadily addressing these challenges.

Growth Opportunities

Key opportunities include:

Industry-specific AIOps solutions for SMEs

Low-code automation features

Managed and outcome-based AIOps services

Conclusion

Organization size plays a crucial role in shaping AIOps adoption strategies. While large enterprises dominate the market today, SMEs are poised to drive future growth. Together, both segments are contributing to the long-term expansion of the AIOps platform market through 2031.

About Us –

The Insight Partners provides comprehensive syndicated and tailored market research services in the healthcare, technology, and industrial domains. Renowned for delivering strategic intelligence and practical insights, the firm empowers businesses to remain competitive in ever-evolving global markets.

Contact Information

Email: sales@theinsightpartners.com

Website: theinsightpartners.com

Phone: +1-646-491-9876

Also Available in : Korean German Japanese French Chinese Italian Spanish