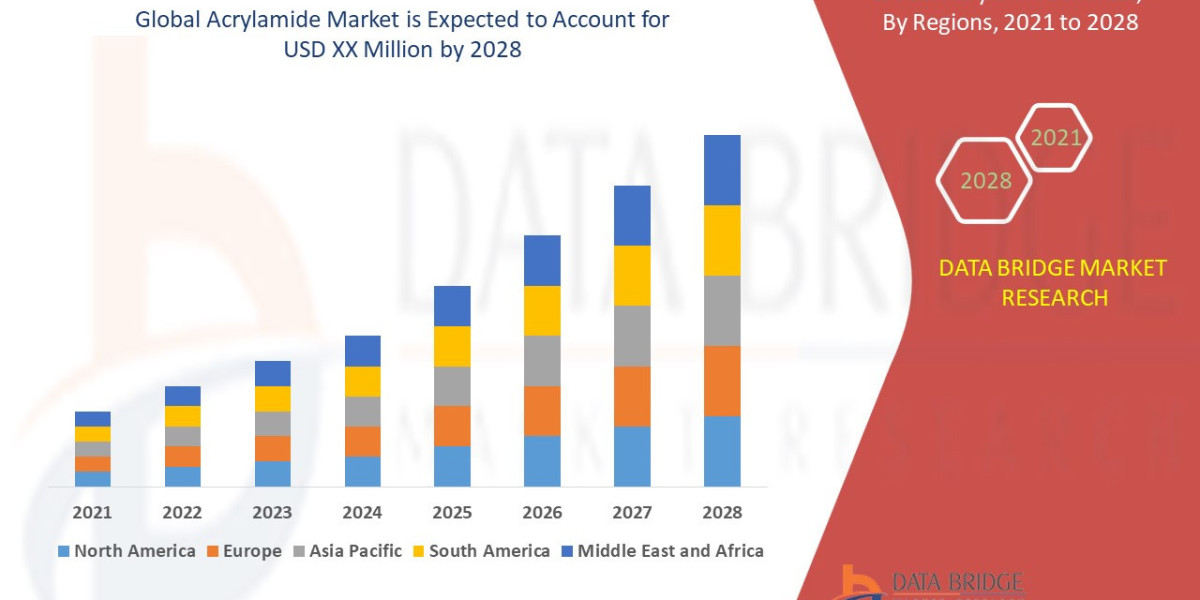

The Tax Compliance Software Market Analysis is witnessing significant growth as organizations increasingly adopt digital solutions to simplify tax management and maintain regulatory compliance. With the rising complexity of tax regulations globally, enterprises are investing in advanced tax filing tools and corporate tax solutions to minimize errors, streamline reporting, and enhance transparency.

Integration with accounting software and automated taxation platforms is a major factor driving market adoption. Businesses are seeking solutions that provide real-time updates on regulatory compliance changes, accurate tax calculations, and audit-ready reports. Regions like North America and Europe show strong adoption trends due to dynamic regulatory frameworks and higher emphasis on compliance automation.

In addition, the India Speech Analytics Market is influencing enterprise operations by offering analytics-driven insights, indirectly supporting financial and tax compliance workflows. Similarly, the rise of the 2.5D IC Flip Chip Product Market reflects technological innovations that improve operational efficiency, including tax-related processes.

Businesses are also looking for tax compliance software that integrates seamlessly with existing ERP and accounting systems. This allows for automated taxation, real-time reporting, and audit-ready corporate tax solutions that reduce manual intervention. AI-powered modules are increasingly being introduced to detect discrepancies, recommend corrections, and ensure adherence to multi-jurisdictional tax requirements.

The market is further driven by the need to reduce operational costs, improve accuracy in tax reporting, and comply with strict regulatory standards. Cloud-based solutions, mobile accessibility, and advanced analytics are expected to shape the future of the tax compliance software market. Vendors are focusing on innovation to provide differentiated offerings, enabling organizations to stay ahead in compliance management.

Report Highlights:

Insights on market size, growth trends, and revenue forecasts

Competitive landscape analysis and vendor strategies

Key drivers including regulatory compliance, tax filing tools, and automated taxation

Regional segmentation: North America, Europe, APAC, South America, and MEA

FAQs:

What is tax compliance software?

Tax compliance software automates tax calculation, filing, and reporting, helping organizations meet legal and regulatory requirements efficiently.How does tax compliance software integrate with corporate systems?

It often integrates with accounting software and ERP platforms to enable seamless data flow, automated taxation, and real-time reporting.What are the main benefits of using tax compliance solutions?

Benefits include error reduction, efficient tax filing, compliance with regulations, real-time updates, and enhanced operational efficiency.

➤➤Explore Market Research Future- Related Ongoing Coverage In Semiconductor Domain: