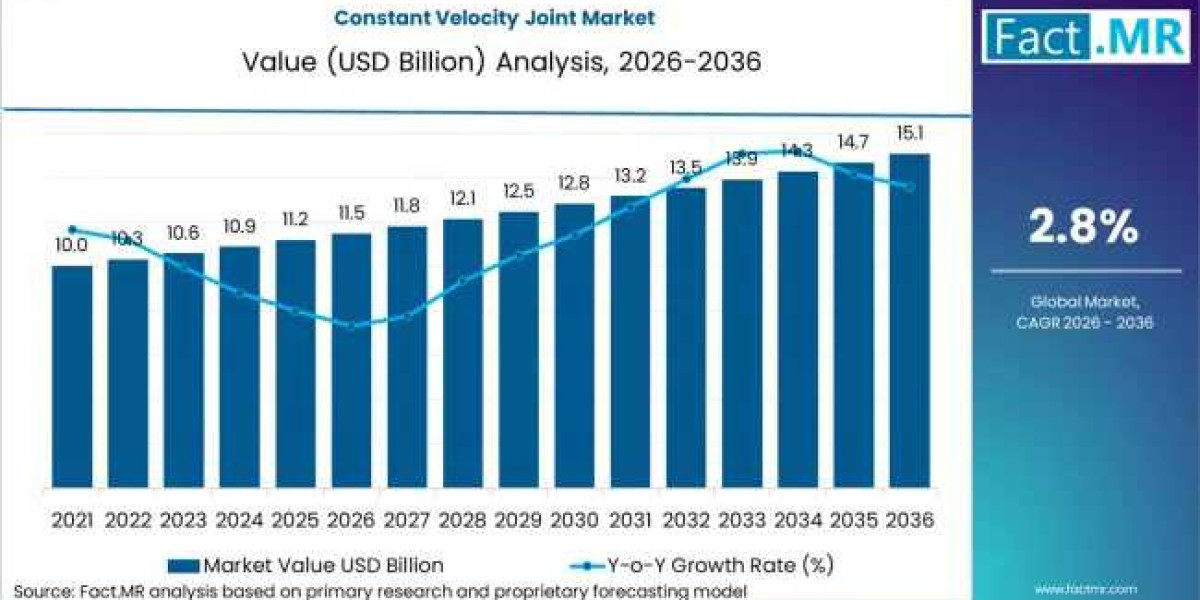

The global Constant Velocity (CV) Joint market is entering a transformative decade, with industry forecasts projecting steady expansion through 2036. Driven by the rapid shift toward electric vehicles (EVs), the demand for high-performance drivetrain systems, and the rising popularity of All-Wheel Drive (AWD) platforms, the market is evolving to meet the rigorous efficiency standards of the next generation of mobility.

As of early 2026, the market is valued at approximately $4.1 billion, with analysts anticipating a compound annual growth rate (CAGR) of roughly 5.4% to 5.7% over the next ten years. This growth trajectory is underpinned by a fundamental re-engineering of automotive power transmission, moving away from traditional Internal Combustion Engine (ICE) requirements toward the high-torque, low-noise demands of electrified powertrains.

Request for Sample Report | Customize Report |purchase Full Report - https://www.factmr.com/connectus/sample?flag=S&rep_id=14077

The Mechanics of Growth: Who, What, and Why

The CV joint market encompasses the design, manufacture, and distribution of critical components that allow a drive shaft to transmit power through a variable angle, at constant rotational speed, without an appreciable increase in friction or play.

Who: Leading Tier-1 suppliers including GKN Automotive, NTN Corporation, Dana Incorporated, SKF AB, and Nexteer Automotive are spearheading R&D efforts.

What: The transition involves a shift from standard Rzeppa and Tripod joints to specialized lightweight and high-durability CV axle assemblies designed for EVs.

Where: The Asia-Pacific region remains the dominant hub, accounting for over 40% of global market share, followed by North America and Europe, where SUV and crossover demand remains high.

Why: Stringent global emission mandates—such as the EU’s 2030 targets and U.S. EV adoption goals—are forcing OEMs to reduce vehicle weight. CV joints, as integral drivetrain parts, are being redesigned using advanced composites and high-strength alloys to contribute to these efficiency gains.

Strategic Market Drivers and Technological Evolution

1. The EV Revolution and Torque Management

Electric motors deliver instantaneous torque, placing higher mechanical stress on drivetrain components compared to ICE vehicles. Consequently, the forecast period (2026–2036) will see a surge in demand for plunging and fixed joints that can handle increased power density while maintaining the near-silent cabin experience expected by EV consumers.

2. Rise of AWD and SUV Segments

Consumer preference for SUVs and Crossovers continues to climb globally. Because these vehicles often utilize AWD or 4WD systems, they require more CV joints per vehicle (typically four to six) compared to standard Front-Wheel Drive (FWD) sedans. This components-per-vehicle increase is a primary volume driver for manufacturers.

3. Sustainability and Smart Manufacturing

Industry leaders are increasingly adopting bio-based lubricants and 3D-printing techniques for precision engineering. Furthermore, the integration of smart sensors into the hub assembly is paving the way for predictive maintenance, allowing fleet operators to monitor CV joint wear in real-time.

Market Segmentation and Competitive Landscape

The market is categorized by joint type, vehicle application, and distribution channel:

By Joint Type: Rzeppa joints currently hold the largest share due to their widespread use in outboard applications for passenger cars, while Tripod joints are gaining ground in heavy-duty and e-axle configurations.

By Vehicle Type: Passenger cars remain the primary revenue generator, but Light Commercial Vehicles (LCVs) are identified as the fastest-growing segment, fueled by the global e-commerce and logistics boom.

By Channel: While Original Equipment Manufacturers (OEMs) dominate the value chain, the aftermarket segment is seeing resilient growth as the average age of the global vehicle fleet increases, requiring replacement parts to maintain roadworthiness.

The next decade will be defined by the intersection of durability and decarbonization, states a lead industry analyst. The CV joint is no longer just a commodity; it is a precision-engineered link vital to the range and reliability of the modern electric fleet.

Looking Ahead: 2026–2036 Outlook

Despite challenges such as fluctuating raw material prices for steel and rubber, the long-term outlook remains robust. The globalization of automotive supply chains and the expansion of manufacturing hubs in emerging economies like India and Southeast Asia are expected to offset regional trade volatility. By 2036, the integration of CV joints into autonomous shuttles and hydrogen-powered commercial trucks is expected to open new frontiers for industry stakeholders.

About the Industry Analysis: This press release is based on consolidated market data and current automotive trends as of Q1 2026. It serves as a strategic brief for investors, analysts, and automotive professionals monitoring the transmission and drivetrain sectors.

Related Reports

CV Joints and Constant Velocity Couplings Market https://www.factmr.com/report/cv-joints-and-constant-velocity-couplings-market

Automotive Ball Joints Market https://www.factmr.com/report/3618/automotive-ball-joints-market

ABS Pump and Modulator Market https://www.factmr.com/report/abs-pump-and-modulator-market

SiC Traction Modules Market https://www.factmr.com/report/sic-traction-modules-market

Search

Popular Posts

-

Fiberglass Pipes Market Gains Traction with Expanding Infrastructure and Industrial Applications

By rahulmarket

Fiberglass Pipes Market Gains Traction with Expanding Infrastructure and Industrial Applications

By rahulmarket -

Soy Milk Market Surges with Increasing Shift Toward Plant-Based and Dairy-Free Alternatives

By rahulmarket

Soy Milk Market Surges with Increasing Shift Toward Plant-Based and Dairy-Free Alternatives

By rahulmarket -

Digital Insurance Platform Market Advances with Increasing Shift Toward Online Insurance Services

By rahulmarket

Digital Insurance Platform Market Advances with Increasing Shift Toward Online Insurance Services

By rahulmarket -

Supply Chain Logistics Market To Reach USD 19.1 trillion by 2033

By KunalD123

Supply Chain Logistics Market To Reach USD 19.1 trillion by 2033

By KunalD123 -

Paper Edge Protectors Market Expands with Surge in E-Commerce and Logistics Activities

By rahulmarket

Paper Edge Protectors Market Expands with Surge in E-Commerce and Logistics Activities

By rahulmarket